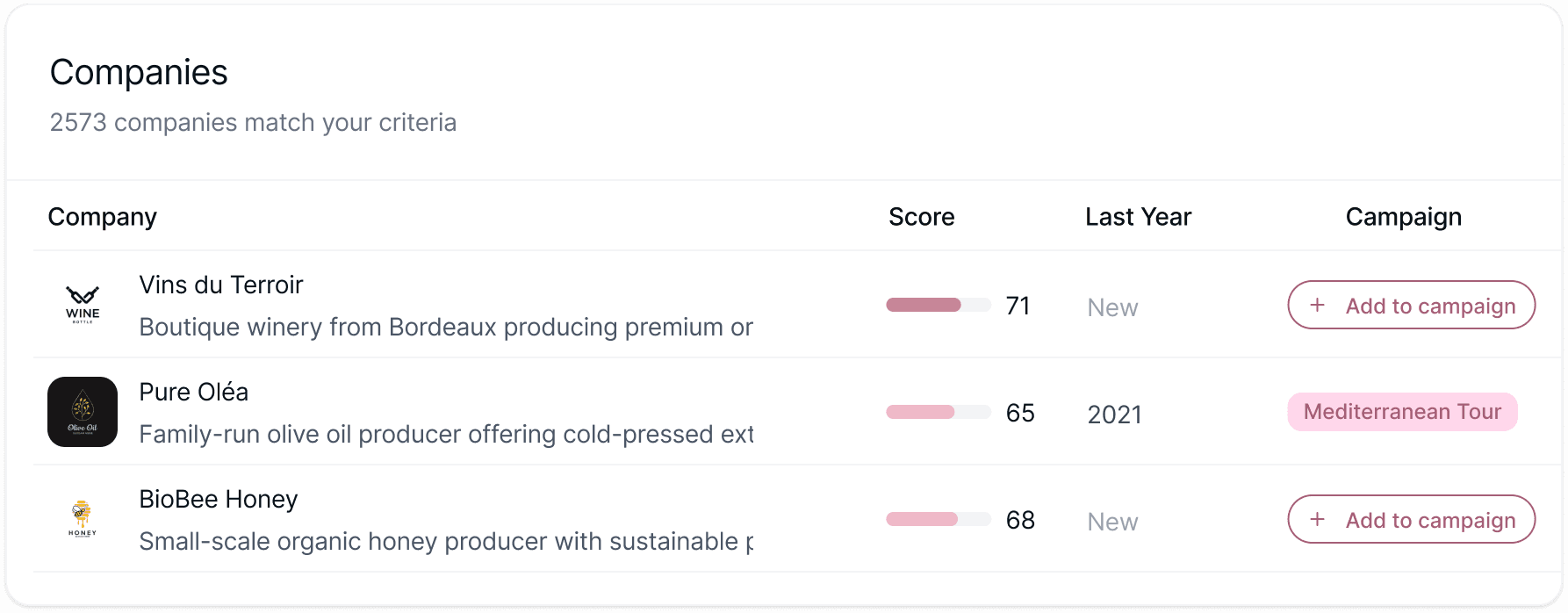

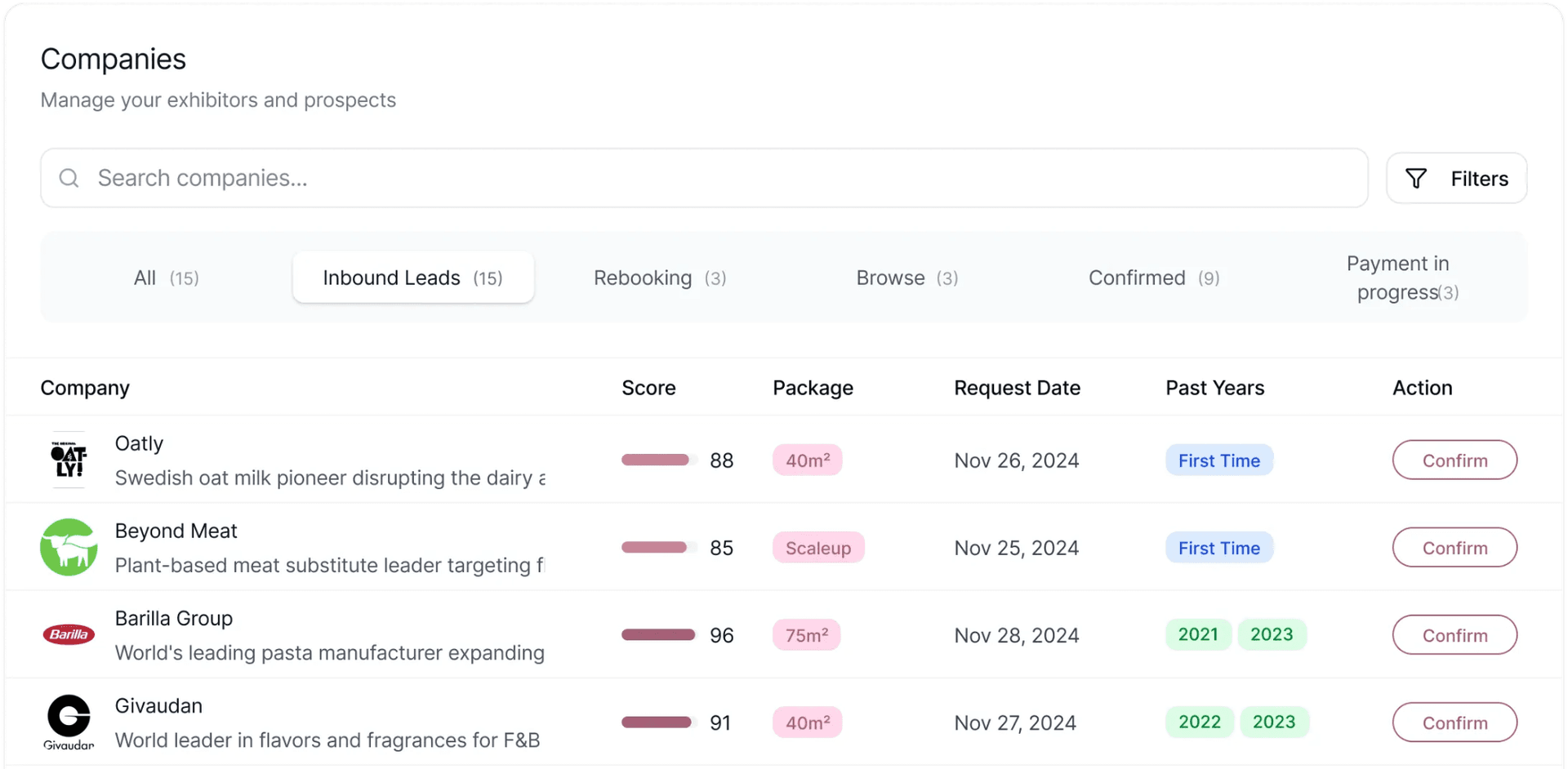

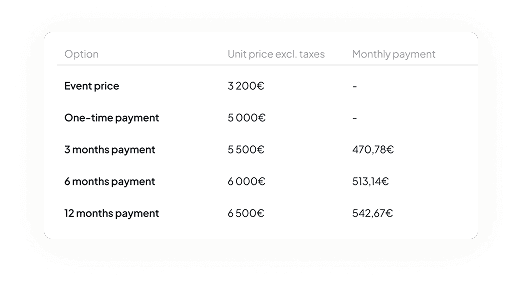

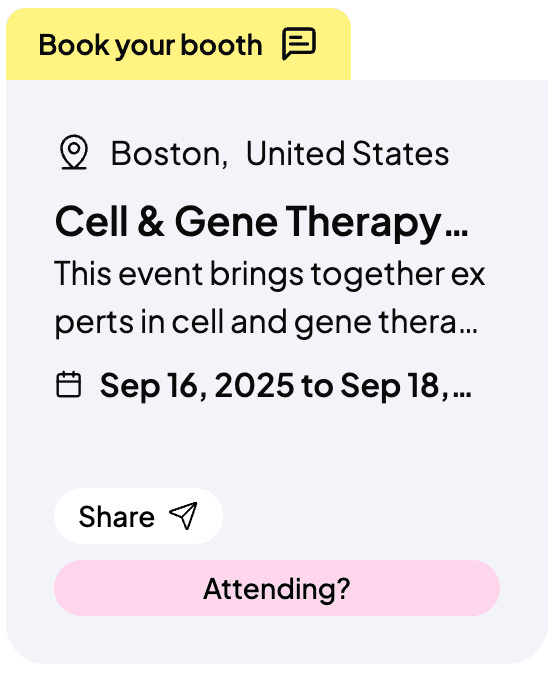

From exhibitor sales to content to matchmaking, Sesamers is creating the core event infrastructure built on rich customer data

.png&w=1920&q=75&dpl=dpl_8SWKrhabxKnCPnFCdWrhmB7Gio9j)

The all-in-one platform to tie your event together

.png&w=1920&q=75&dpl=dpl_8SWKrhabxKnCPnFCdWrhmB7Gio9j)

.png&w=1920&q=75&dpl=dpl_8SWKrhabxKnCPnFCdWrhmB7Gio9j)

Trusted by leading events worldwide

Don't take our word for it

"The event strategy from Sesamers transformed our approach completely. We went from random event participation to a systematic approach that actually drives results. Our ROI increased by 340% in just 6 months."

"Working with Sesamers has been a game-changer for our event strategy. Their AI-powered insights helped us identify the perfect events for our growth stage, resulting in meaningful connections and significant pipeline expansion."

"Sesamers helped us secure speaking opportunities at key events and facilitated valuable connections. We became speakers at 2 major events and generated 5 strategic partnerships that accelerated our growth significantly."

"Sesamers didn't just help us with our event strategy but also made introductions to qualified business angels. Their network and guidance helped us."

"The event strategy from Sesamers transformed our approach completely. We went from random event participation to a systematic approach that actually drives results. Our ROI increased by 340% in just 6 months."

"Working with Sesamers has been a game-changer for our event strategy. Their AI-powered insights helped us identify the perfect events for our growth stage, resulting in meaningful connections and significant pipeline expansion."

"Sesamers helped us secure speaking opportunities at key events and facilitated valuable connections. We became speakers at 2 major events and generated 5 strategic partnerships that accelerated our growth significantly."

"Sesamers didn't just help us with our event strategy but also made introductions to qualified business angels. Their network and guidance helped us."

"The event strategy from Sesamers transformed our approach completely. We went from random event participation to a systematic approach that actually drives results. Our ROI increased by 340% in just 6 months."

"Working with Sesamers has been a game-changer for our event strategy. Their AI-powered insights helped us identify the perfect events for our growth stage, resulting in meaningful connections and significant pipeline expansion."

"Sesamers helped us secure speaking opportunities at key events and facilitated valuable connections. We became speakers at 2 major events and generated 5 strategic partnerships that accelerated our growth significantly."

"Sesamers didn't just help us with our event strategy but also made introductions to qualified business angels. Their network and guidance helped us."

"The event strategy from Sesamers transformed our approach completely. We went from random event participation to a systematic approach that actually drives results. Our ROI increased by 340% in just 6 months."

"Working with Sesamers has been a game-changer for our event strategy. Their AI-powered insights helped us identify the perfect events for our growth stage, resulting in meaningful connections and significant pipeline expansion."

"Sesamers helped us secure speaking opportunities at key events and facilitated valuable connections. We became speakers at 2 major events and generated 5 strategic partnerships that accelerated our growth significantly."

"Sesamers didn't just help us with our event strategy but also made introductions to qualified business angels. Their network and guidance helped us."

We're on a mission to build the event industry infrastructure

Let's talk

All your questions answered

Resources